what is the inheritance tax rate in virginia

The estate tax rate is 40 so you should do everything in your power to minimize any estate tax exposure. The tax shall be withheld on the entire amount of the prize not merely the amount in excess of 5000.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

What is the difference between an inheritance tax and.

. Ad Inheritance and Estate Planning Guidance With Simple Pricing. In fact only seven states access have an inheritance tax. How is personal property tax calculated on a car in virginia.

The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of. In general all sales leases and rentals of tangible personal property in or for use in Virginia as well as accommodations and certain taxable services are subject to Virginia sales and use tax. Inheritance tax rates differ by the state.

The tax rate varies. Virginia does not have an inheritance tax. Note that historical rates and tax laws may differ.

Hawaii and washington state have the. Ad Virginias 1 online provider. For any prize over 5000 the Virginia Lottery automatically withholds 24.

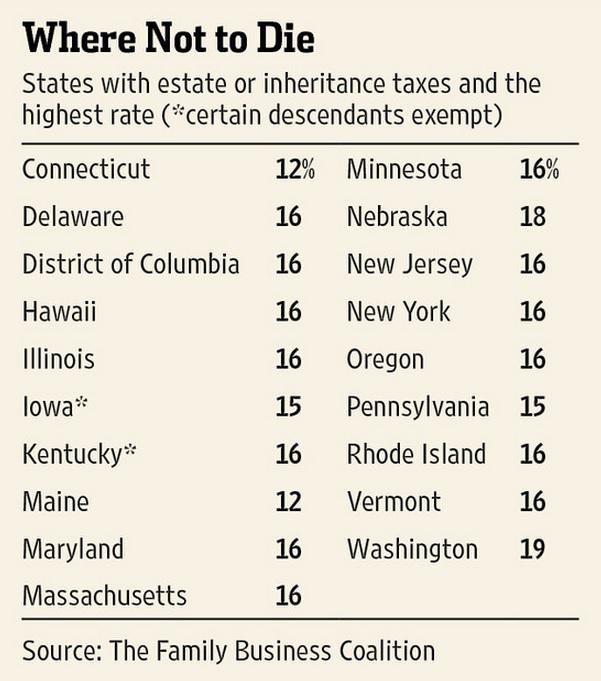

Gift tax and inheritance tax in West Virginia. These states have an inheritance tax. As of 2021 the six states that charge an inheritance tax are.

The tax is assessed at the rate of 10 cents per 100 on estates valued at more than 15000 including the first 15000 of assets. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. Below are the ranges of inheritance tax rates for each state in 2021 and 2022.

There is no gift tax in West Virginia and this fact became an essential part of the estate planning strategy for people with. A strong estate plan starts with life. Just click print sign.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

Price at Jenkins Fenstermaker PLLC by. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

States With No Estate Tax Or Inheritance Tax Plan Where You Die

2020 Estate And Gift Taxes Offit Kurman

State Death Tax Is A Killer The Heritage Foundation

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

Inheritance Tax Here S Who Pays And In Which States Bankrate

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

What Is Inheritance Tax Probate Advance

The Death Tax Taxes On Death American Legislative Exchange Council

In Addition To The Federal Estate Tax With A Top Rate Of 40 Percent Some States Levy An Additional Estate Or Inheritan In 2022 Inheritance Tax Estate Tax Inheritance

Inheritance Tax Here S Who Pays And In Which States Bankrate

Estate Tax Rates Forms For 2022 State By State Table

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Countries With Or Without An Estate Or Inheritance Tax Policy And Taxation Group